|

| |

||||||

Corporation SoleSecretary Of State Registrations

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

It must be emphasized the corporation sole is completely different from the corporation 26 U.S.C.S. 501(c)(3) status in almost every conceivable way. It is not a corporation as in the classification of corporation. Corporation Sole vs. 501(c)(3) Corporation, by Elizabeth Gardner, pg. 36 |

I say that Elizabeth Gardner "published" her booklet, rather than "authored" it, because Elizabeth Gardner is far more a plagiarist than an author. In point of fact she stole much of the content of her booklet from me (see Corporation Sole Problems). Even some of the language on the Bethel Aram Ministries web site is taken directly from one of my books.

Irrespective of Elizabeth Gardner's claims that a corporation sole isn't a corporation, "as in the classification of corporation," "Office Of Presiding Head Prophetess Elizabeth A. Gardner After The Order Of Melchizedek, and Her Successors, a Corporation Sole of Beth Aram Ministries" is legally classified by Nevada as a "Non-profit Corporation."

Given that Nevada, and all other states that legally recognize the corporation sole, classify every corporation sole as a "nonprofit corporation," it's completely illogical and blatantly dishonest for Elizabeth Gardner to claim that the corporation sole is little other than a government-registered nonprofit corporation, and her Nevada Secretary Of State incorporation registration proves that point (see the text highlighted in red, below).

|

Dean Heller Nevada Secretary of State Corporate Information |

|

| Name: OFFICE OF PRESIDING HEAD PROPHETESS OF ELIZABETH A. GARDNER AFTER THE ORDER OF THE LORD JESUS CHRIST, THE HIGH PRIEST AND KING AFTER THE ORDER OF MELCHIZEDEK, AND HER SUCCESSORS, A CORPORATION SOLE OF BETH ARAM MINISTRIES |

| Type: Corporation | File Number: C26216-2001 | State: NEVADA | Incorporated On: September 27, 2001 |

| Status: Articles Filed | Corp Type: Non-profit | ||

| Resident Agent: | CDACS ENTERPRISES, LLC (Accepted) | ||

| Address: | 1970 GOLDEN SHADOW COURT | ||

| HENDERSON | NV | 89015- | |

| President: | ELIZABETH A GARDNER | ||

| Address: | PO BOX 952 | ||

| BLACK CANYON CITY | AZ | 85324 | |

| Secretary: | |||

| Address: | |||

| - | |||

| Treasurer: | |||

| Address: | |||

| - | |||

Corporation sole peddlers, like Elizabeth Gardner and Bethel Aram Ministries, often specifically target legitimate churches for their corporation sole peddling. Churches provide fertile ground for lucrative sales opportunities because, once they're inside a church, they will peddle the corporation sole to just about anyone else, whether or not they're the head of a legitimate church or ministry. They'll attempt to convince church members that just about anything they engage in is "spiritual" and, therefore, by their expansive definition must be a "church" or a "ministry." Ostensibly such "spiritual" pursuits qualify under the 508 mandatory exception they allege is afforded by the corporation sole. Targeting churches is a shrewd sales move as it provides Elizabeth Gardner many sales opportunities with many church members.

Elizabeth Gardner claims to be a corporation sole legal expert. However, in reviewing her materials I've found the alleged "expertise" of Elizabeth Gardner to be at least as lacking as any other corporation sole peddler, and probably even more so (all corporation sole peddlers, by virtue of the myths they believe and promote, are legal ignoramuses; however some are bigger ignoramuses than others). Following Elizabeth Gardner's so-called "legal expertise" is likely to get people into serious trouble, particularly with the IRS.

Just like many other corporation sole hucksters, Elizabeth Gardner also claims legal expertise in other areas, such as asset protection through the use of trusts. However, I've reviewed her trust materials (How To Protect Everything You Own During Your Lifetime and After) and would issue the exact same caution. No plagiarizing legal ignoramus is capable of protecting anyone's assets -- quite the opposite. Charlatans masquerading as "experts" are a dime–a–dozen on the internet. Identifying genuine expertise is a different matter, altogether.

Update 10/19/05: Elizabeth A. Gardner and Frederic A. Gardner of Bethel Aram Ministries sued by U.S. Department of Justice, Tax Division. DOJ seeks a Permanent Injunction to stop alleged tax fraud promotion by the Gardners, including selling the corporation sole.

Update 10/19/05: Elizabeth A. Gardner and Frederic A. Gardner of Bethel Aram Ministries sued by U.S. Department of Justice, Tax Division. DOJ seeks a Permanent Injunction to stop alleged tax fraud promotion by the Gardners, including selling the corporation sole.

As is typical of these injunctions, DOJ has petitioned the court that:

The IRS, through the DOJ, has sought a number of such Permanent Injunctions against corporation sole peddlers. I have yet to see any corporation sole peddler beat the DOJ. Elizabeth Gardner is one of the most legally incompetent of all the corporation sole peddlers, so it's a sure bet she will lose.

Furthermore, the federal courts have consistently upheld DOJ's petitions to compel corporation sole peddlers to turn over a list of all their clients. If the Gardners refuse to turn over their client lists they'll be held in contempt and jailed. However, the Gardners won't have the benefit of being jailed together, or even with other prisoners. Federal judges generally enforce contempt charges with solitary confinement. Few prisoners can withstand that kind of punishment long-term, so sooner or later the Gardners will turn over their client lists. The only way for them to avoid doing so is to flee the country. Other corporation sole peddlers who were hit with Permanent Injunctions (such as Eddie Kahn, who fled to Panama) have done just that. Once they leave they can never come back.

It's just a matter of time before Elizabeth Gardner's clients find themselves being sweated out by the IRS. It would appear that most of the corporation soles peddled by the Gardners were total shams, and only a few were sold to real churches. Unfortunately, those few real churches are going to be subjected to the same kind of intense IRS scrutiny as all the shams. They should all be proactive and move swiftly to extricate themselves from the quagmire that Elizabeth Gardner has dumped them in.

Jeffrey C. Thayer is the author of, The Corporation Sole, It's History, Significance and Creation. The book is included as part of a $500.00 class that Thayer has taught in numerous places around the country.

Corporation sole peddlers tend to be colorful and unusual individuals; but Jeffrey Thayer takes top billing as the most outlandish of them all. Jeffrey Craig Thayer is a disbarred attorney from California. In 1993 Jeffrey Thayer changed his name to Geoffrey Craig benRichard barAbba. Far more impressive than his "J.D." title (which, uncharacteristic of a disbarred attorney, he still bandies about) is his title, "High Priest." Jeffrey Thayer actually earned the title, "J.D." However, the title "High Priest" is merely self-appointed.

It takes a considerable degree of audaciousness to be a corporation sole peddler, and Jeffrey Thayer sets the benchmark for arrogance. Jeffrey Thayer possesses such a degree of self-aggrandizing pretentiousness that he claims his office of "High Priest" was handed down to him through a succession of some two-thousand years, originating with Joseph of Arimathea, the founder of the Olde Culdee Church in Glastonbury, England.

Jeffrey C. Thayer organized his "Olde Culdee Church" as a Nevada corporation sole. Even though his position was supposedly a "perpetual office," it didn't seem to last very long. After only seven years, the State Of Nevada revoked his corporation sole.

Jeffrey C. Thayer organized his "Olde Culdee Church" as a Nevada corporation sole. Even though his position was supposedly a "perpetual office," it didn't seem to last very long. After only seven years, the State Of Nevada revoked his corporation sole.

Jeffrey Thayer originated the myth that by including a "pre-article history of the office" in the articles of incorporation, the State would take legal cognizance of the church's historic existence as predating the existence of the State. On that basis, the State would not treat any such corporation sole as a "creature of the State," nor would they classify any such corporation sole as a nonprofit corporation. Jeffrey Thayer's "pre-article history of the office" theory makes for a convincing sales ploy, and so many other corporation sole peddlers are now repeating the theory, as well.

However, like so many of Jeffrey Thayer's other theories, the "pre-article history" theory is completely bogus, and no state recognizes it. Certainly the State Of Nevada doesn't buy it. The corporation sole that Jeff Thayer operates through, as well as every corporation sole that he has ever peddled, is registered as a nonprofit corporation:

|

Dean Heller Nevada Secretary of State Corporate Information |

|

| Name: OFFICE OF THE HIGH PRIEST AFTER THE ORDER OF MELCHIZEDEK OF THE OLDE CULDEE CHURCH, AND HIS SUCCESSORS, A CORPORATION SOLE, THE |

| Type: Corporation | File Number: CS5404-1998 | State: NEVADA | Incorporated On: March 13, 1998 |

| Status: Revoked on 4/1/2005 | Corp Type: Non-profit | ||

| Resident Agent: | MELANIE MILLER, SUI JURIS | ||

| Address: | 1393 DOROTHY AVENUE | ||

| LAS VEGAS | NV | 89119 | |

| President: | |||

| Address: | |||

| Secretary: | |||

| Address: | |||

| - | |||

| Treasurer: | |||

| Address: | |||

| - | |||

Not only is Jeffrey Thayer's "pre-article history" theory legally specious, it's also historically specious. Jeffrey Thayer is incapable of bringing forth any credible historic evidence of predecessors of his office of "High Priest" because there are no predecessors. Jeffrey Thayer has never succeeded a legitimate clergyman of a legitimate church office, and he never will, because no legitimate church would be stupid enough to have anything to do with him, especially in the capacity of the priesthood.

Subsequent to being disbarred as an attorney, Jeffrey Thayer was admitted to practice law in the Dominion of Melchizedek Bar Association (since he is also the Governor of the Bar Association of the Dominion of Melchizedek, he didn't have much trouble passing the bar exam). Such an honor entitles him to practice law on Taongi, an uninhabited (and uninhabitable) "dry and barren" South Pacific atoll. However, "Melchizedekians" like Jeffrey Thayer only feign "dominion." Taongi is populated by nothing but seagulls, and the "Melchizedekians" have no plans to ever develop their 1.25 square mile atoll (most of which is submerged).

Subsequent to being disbarred as an attorney, Jeffrey Thayer was admitted to practice law in the Dominion of Melchizedek Bar Association (since he is also the Governor of the Bar Association of the Dominion of Melchizedek, he didn't have much trouble passing the bar exam). Such an honor entitles him to practice law on Taongi, an uninhabited (and uninhabitable) "dry and barren" South Pacific atoll. However, "Melchizedekians" like Jeffrey Thayer only feign "dominion." Taongi is populated by nothing but seagulls, and the "Melchizedekians" have no plans to ever develop their 1.25 square mile atoll (most of which is submerged).

The founders of the Dominion of Melchizedek are the felonious father-son crime team, David Pedley and Mark Pedley (aka Branch Vinedresser aka Tzemach Ben David Netzer Korem). Together they "translated" and published the Melchizedek Bible, giving it their own unique Christian Science spin.

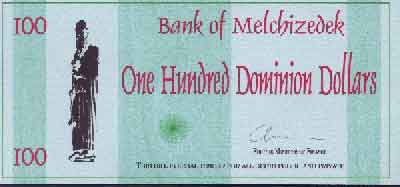

David and Mark Pedley are career malefactors, and the Dominion of Melchizedek has swindled many millions of dollars from thousands of people by peddling a myriad of scams such as bank debentures and Ponzi schemes, bank charters, insurance company licenses, fraudulent securities, worthless bonds, phony treasury bills, and even "Bank of Melchizedek Dominion Dollars."

The Dominion Of Melchizedek has welcomed with open arms some of the world's most notorious con artists, selling them passports and various government positions, such as "Ambassador." Among these are included Gilbert Allen Ziegler aka Van A. Brink, who through his infamous Fidelity International Bank and First International Bank of Grenada defrauded depositors and investors for over $200 million. In other words, the Dominion of Melchizedek is nothing but a crime syndicate that welcomes (for a fee, of course) any and all bandits who wish to cloak themselves in impressive titles and ecclesiastical rhetoric.

The Dominion of Melchizedek claims to have a "Supreme Court," the "Chief Justice" of which is "The Honorable Tzemach Ben David Netzer Korem," which hands down huge judgements against those that in any way offend them (no doubt my statements here will earn a huge judgement against me too).

Not surprisingly, the Dominion of Melchizedek has a Corporation Sole Act, which Jeffrey Thayer was responsible for drafting. Jeffrey Thayer also has the distinction of being "Ambassador At Large" for the Dominion of Melchizedek, and his alliance with this mob of racketeers is only too fitting. Like so many of his corporation sole peddling peers, "Ambassador At Large" Jeffrey Thayer not only peddles shams, he is a sham.

Just like his fellow corporation sole hucksters, Jeffrey Thayer is nothing more than a swindler masquerading behind sham titles in religious rhetoric to peddle sham churches and sham church offices with sham office titles (e.g. High Priest, Bishop, Archbishop, etc.), for little other motive than self-aggrandizement, cupidity and tax evasion. Jeffrey Thayer isn't the exception but the norm among corporation sole peddlers. Most of them are charlatans and con artists masquerading as "Christian ministers" (albeit, none of them have yet bested Jeffrey Thayer).

As a direct result of his illicit activities, Jeffrey Craig Thayer took an extended absence from the world of his fellow sovereign citizens to join the world of the incarcerated in federal prison and, as such, he is not at present peddling corporation soles, or any of his various other scams. However, while he was an active huckster, Jeffrey Thayer trained quite a few other corporation sole hucksters (e.g. Elizabeth Gardner); and so even while he is in prison his impact is still felt widely.

A Washington-based corporation sole peddler who has played a significant part in making Washington state such a popular place for organizing the corporation sole (second only to Nevada) is Glen Stoll, of Remedies At Law. Glen Stoll is just one among many corporation sole peddlers who claims that a corporation sole is "unincorporated."

Glen Stoll has organized many a corporation sole. Few, if any, are actually churches, and many are profitable business ventures. Glen Stoll thinks that, as long as you believe in God, you can be the head of your own corporation sole "church" and everything you do is "church." Even your business is a "church." Since your business becomes a "church," it doesn't have to pay taxes, and since you're the head of your own corporation sole "church" you don't owe any personal taxes either.

In one case, Glen Stoll claimed that one of his clients that ran a retail storefront yoga studio was actually a church. The yoga studio couldn't be construed as a church by anyone's definition but Mr. Stoll's. Glen Stoll informed the county in writing that, since the yoga studio was a "church," it wasn't liable for property taxes, and they would refuse to pay the property tax bill. He also refused to pay to renew the yoga studio's business license. As one might imagine, a contentious legal battle ensued. Mr. Stoll appears to enjoy going out of his way to pick a fight with the government. Such battles cost him nothing personally, and his clients will have to pay all the bills and suffer all the stress.

Glen Stoll operates an impressive scheme, a scheme which is all too common among corporation sole peddlers. His clients pay him to deliver on promises of "freedom" and "personal sovereignty," but all he does is get them into serious trouble. Then they pay him even more to get them out of trouble. Unfortunately, in paying him to get them out of the trouble he got them into in the first place, all he seems capable of doing is getting them into even worse trouble. As long as the client's money holds out Glen Stoll will continue the cycle; but when the money's gone Glen Stoll will be gone as well.

Glen Stoll is high-profile, and well known to the legal authorities in Washington state and the IRS. Becoming a Glen Stoll client means that you are guaranteed to place yourself on the government radar screen and become a target of opportunity.

The following search result, from the Washington Secretary Of State, is for just one of the many corporation soles that Glen Stoll has organized. Though Glen Stoll claims that a corporation sole is "unincorporated," note that Washington, just like all other states, legally classifies and treats the corporation sole as a nonprofit corporation:

Updates: On February 15, 2005 the DOJ filed suit in federal court against Glen Stoll and Remedies At Law for an Injunction barring him from, among other things, peddling corporation soles. Like all the other corporation sole peddlers, Glen Stoll claims legal expertise which he does not possess. Glen Stoll is such a legal genius that he didn't even bother to respond to DOJ's Complaint For Permanent Injunction. His failure to respond resulted in a default judgement being entered against him.

On April 27, 2005 the court issued a Preliminary Injunction.

On July 6, 2005 the court issued a Permanent Injunction, granting everything that DOJ had petitioned for.

As part of the Injunction, the court has ordered that Glen Stoll turn over a list of all his clients. From all appearances, Glen Stoll has failed to comply with this, and every other order in the Injunction. Glen Stoll is at present showing some "loyalty" to his clients (customer loyalty probably has nothing to do with it -- Glen Stoll refuses to turn over his client lists because those lists would be used as evidence to prosecute him). However, there are limits to any corporation sole peddler's "loyalty." Sooner or later Glen Stoll will be held in contempt and jailed.

Federal judges have a habit of coercing compliance with their orders through the use of solitary confinement. No corporation sole peddler is going to spend the rest of his life alone in jail so, sooner or later, Glen Stoll will hand over what the government demands. And when he does, the real bloodbath begins.

Bad times are looming on the horizon for all of Glen Stoll's clients. An accountant who has first-hand knowledge has informed me that many of Glen Stoll's clients have been identified and are already being raked over the coals by the IRS. In all likelihood, they're also under criminal investigation by IRS CID. The likelihood of a slew of criminal indictments being handed down is very high.

There are ways that Glen Stoll's clients can probably avoid going to jail, but not by riding it out with Glen Stoll. When Glen Stoll's ship goes down it wouldn't be smart to be in the same boat.

Brent-Emory Johnson is a classic example of how corporation sole peddlers employ comparative logic in a defective way to derive preposterous conclusions. As an example, Brent Emory Johnson states on his web site:

I agree that a corporation sole is "a different breed." However, Brent Johnson is being illogical, if not duplicitous, when he claims that, "A corporation sole is not a corporation" merely because, "Corporations sole are different." Employing the same logic we could claim that, "A Valencia Orange is an Orange. A Naval Orange is a different breed. Therefore, a Naval Orange is not an Orange."

Even if a corporation sole were significantly different from other nonprofit corporations (they are not "altogether different," and most of Brent Johnson's other claims are equally bogus), that would hardly lend enough logical credence to be able to claim that a corporation sole is not a corporation. A corporation sole is indeed a "breed." According to case law the corporation sole is a breed (a species) of State incorporation that is remarkably similar to other nonprofit corporations, and particularly nonprofit religious corporations. Brent Johnson typifies the vast majority of corporation sole peddlers who are either:

Brent Johnson, along with his "partner" Lee Parker, operate Freedom Bound International, and are the hosts of the patriot radio show, "Voice Of Freedom." Brent Johnson's radio program gives him the opportunity to portray himself as an expert on a vast array of "freedom" subjects and to peddle various "freedom" merchandise, including the corporation sole.

Secretary Of State registrations tell us something about how a state views the legal status of what it is registering. For example, notice in the registration information immediately below (highlighted in red), how Nevada classifies "Presiding Patriarch" Brent Emory Johnson, as well as every other corporation sole. Like most other corporation sole peddlers, Brent Johnson claims that a corporation sole isn't a corporation. However, that doesn't square with the legal opinion of the Nevada Secretary Of State, or any other Secretary Of State. Brent Johnson's corporation soles are all legally classified as a "Non-profit Corporation":

|

Dean Heller Nevada Secretary of State Corporate Information |

|

| Name: OFFICE OF THE FIRST PRESIDING PATRIARCH (OVERSEER) AND HIS SUCCESSORS, A CORPORATION SOLE OVER/FOR AN UNINCORPORATED RELIGIOUS SCRIPTURAL SOCIETY, IN THE NATURE OF ECCLESIA, EMORY EVANGELICAL |

| Type: Corporation | File Number: CS16517-1998 | State: NEVADA | Incorporated On: July 13, 1998 |

| Status: Articles Filed | Corp Type: Non-profit | ||

| Resident Agent: | RITE, INC. (Accepted) | ||

| Address: | 1905 SOUTH EASTERN AVE. | ||

| LAS VEGAS | NV | 89104 | |

| President: | BRENT EMORY JOHNSON | ||

| Address: | 1905 SOUTH EASTERN AVE. | ||

| OVERSEER | |||

| LAS VEGAS | NV | 98104 | |

| Secretary: | |||

| Address: | |||

| - | |||

| Treasurer: | |||

| Address: | |||

| - | |||

Corporation sole peddlers claim that by coming up with just the right name a corporation sole becomes an unincorporated, unregistered, non-statutory, canon law, ecclesiastical entity. Just like his fellow corporation sole peddlers, Brent Johnson makes a big issue over what name his clients choose for any corporation sole they buy from him. Brent Johnson deceives his clients into believing that the corporation soles he peddles are "unincorporated." He does so by including "an unincorporated religious. . ." in the name of every corporation sole he peddles.

By such trickery Brent Johnson has swindled many. Brent Johnson's craftiness has produced impressive sales figures for himself, Lee Parker, and Freedom Bound International. The public records reflect that he's organized well over one-hundred corporation soles, and there may be many more we're not aware of. At several thousand dollars a pop life can be good for a "paytriot."

The process of legally forming any corporation always involves filling out and filing government forms with the Secretary Of State's office in the state in which the corporation is being organized. As such, it's impossible to organize an "unregistered" corporation sole, and several things should be immediately apparent from these government registrations:

Nevada has become an especially popular state for organizing the corporation sole. According to corporation sole sales companies, Nevada statutes "are more favorable toward the corporation sole, than other states." A search on the Nevada Secretary of State's Corporation Search site on the terms "corporation sole" and "office of" will return hundreds of hits.

You may notice that the names of corporation sole officers aren't always shown in corporation sole registrations. Up until recently, Nevada required only minimal corporation sole disclosure, such as the name and address of the Resident Agent. That was a distinct privacy advantage of the Nevada corporation sole, and corporation sole peddlers have often used that privacy feature as part of their sales pitch.

However, in November 2003 the Nevada legislature changed corporation sole registration requirements under Senate Bill 1. Many corporation soles are not in compliance with the new disclosure law, and failure to comply will result, sooner or later, in those corporation soles being held in "default" (see examples below). There can be serious legal liabilities and consequences in the case of a prolonged default.

Andrew DeDominicis runs Impact Ministries International and gets upwards of $3,500 a pop for the corporation sole. "Brother Andrew" (as he calls himself) claims he can show you how to, "Lawfully unshackle the Church from statutory governmental protocols and Public Policy," by purchasing a corporation sole from him. Yet, a quick review of his own Nevada Secretary Of State registration seems to indicate that he doesn't know how to unshackle himself, let alone how to unshackle anyone else.

The house church and underground church movement in China know something of what it means to be "unschackled." They've got enough common sense to know that government registration of a church is a real stupid idea. In fact, they specifically refer to their churches as "unregistered churches." Yet Brother Andrew equates government registration with being unshackled!

I just have to wonder how many government-registered corporation sole churches would Brother Andrew be able to peddle in China? Smart Christians wouldn't be interested. In fact a smart Christian would have to wonder if Brother Andrew weren't actually working for the government. The Chinese government would sure love what he's peddling. Brother Andrew would be a real asset in helping the government round up all the registered Christians.

Update 8-30-04: See the corporation sole debate between Peter Kershaw and Andrew Dominicis at 501c3 Church Forum. Brother Andrew is also questioned regarding his business relationships with investment scam artists and Ponzi scheme hucksters, such as Linda Kruger of Office Of The Presiding Overseer Of Living By The Word Ministries, A Corporation Sole (LBTW, "Let's Prosper Together" and "LPT2") and Laurel LaFerrara of Office Of The Presiding Managing Director Of Ralph LaFerrara Outreach Mission And Her Successors, A Corporation Sole.

"Brother Andrew" isn't the exception. A remarkable number of corporation sole peddlers are involved directly or indirectly in Ponzi schemes and investment fraud. The corporation sole industry continues to attract many con artists.

|

Dean Heller Nevada Secretary of State Corporate Information |

|

| Name: OFFICE OF THE PRESIDING CHAPLAIN OF IMPACT MINISTRIES INTERNATIONAL, AND HIS SUCCESSORS, A CORPORATION SOLE |

| Type: Corporation | File Number: C4808-2002 | State: NEVADA | Incorporated On: February 26, 2002 |

| Status: Current list of officers on file | Corp Type: Non-profit | ||

| Resident Agent: | IMPACT MINISTRIES INTERNATIONAL (Accepted) | ||

| Address: | 3983 S. MC CARRAN BLVD. | ||

| #418 | |||

| RENO | NV | 89502-7510 | |

| President: | ANDREW DEDOMINICIS | ||

| Address: | 1437 E FRANKLIM BLVD STE 108 | ||

| CHAPLAIN | |||

| CHARLOTTE | NC | 28054- | |

| Secretary: | |||

| Address: | |||

| - | |||

| Treasurer: | |||

| Address: | |||

| - | |||

The following search result is the government registration for a corporation sole sales company by the name of "Gamaliel Ministries" run by Burney Brushears. Gamaliel Ministries will charge you $5,000.00 if you want to buy a corporation sole from them. Yet they are government-registered as a "nonprofit corporation."

Update 4-17-04: The "Bishop" of Gamaliel Ministries, who judging from the public record is Burney Brushears (however, the "Bishop" refuses to disclose his name in his correspondence to me, seeking rather to hide behind a title), sent me an email objecting to the information I posted here. You can view a copy of his email, along with my response. If I receive any further correspondence from the "Bishop" I will post it. Since the "Bishop" denied that his corporation sole peddling is anything at all like all the other corporation sole peddlers, I enjoyed the opportunity of performing a little due diligence to determine if his denials were valid.

Burney Brushears is the author of Strategic Withdrawal, The Peaceful Solutions Manual, a book which purports to offer its reader various strategies for becoming a "sovereign." Burney Brushears offers his clients an opportunity for "coming out of contemporary Babylon," among which he recommends (and sells) the corporation sole.

Burney Brushears is typical of the muddled thinking and dishonesty that is routinely evidenced among corporation sole peddlers. Corporation sole peddlers claim that by obtaining articles of incorporation as a corporate sole "church" or "religious society" (in the same way that Burney Brushears uses "Bishop" as a sham title, it's doubtful that Gamaliel Ministries has formed anything other than sham churches) they are thereby exiting the system and become "sovereign."

On his web site Burney Brushears makes the outlandish claim that the corporation sole is "completely separate from the system." How does incorporating as a government-registered nonprofit corporation result in "coming out of contemporary Babylon"? In light of the fact that all corporations are "creatures of civil law" and "creatures of the State," quite obviously it doesn't. In point of fact, what "Bishop" Burney Brushears claims he's doing for his clients is quite the opposite of what he actually delivers. He promises "freedom" and "personal sovereignty," but what he clamps on are the fetters of a government-subservient government-registered corporate officer.

Many of Burney Brushears' clients are in serious trouble with the government. There's very little Burney Brushears can now do to help his clients, even if he was legally competent to do so. Burney Brushears' strategies in "sovereignty" have worked out so well that it resulted in his having to flee the country. When people buy Burney Brushears' book, or attend his seminar, they probably aren't interpreting "coming out of contemporary Babylon" as having to flee their homeland.

Burney Brushears now makes his abode in Sonora, Mexico. He still claims to be a "sovereign." He's just not "sovereign" enough to be able to enter the United States.

Update 8-25-04:

Burney the "Bishop" has failed to respond to my email. Were he capable of mounting any kind of rejoinder, one can only suppose that he would have done so several months ago. If he can't defend himself now, how can he be expected to defend his own clients when they get hauled into federal court for tax evasion (that was a rhetorical question -- he's not free to come into the United States to defend his clients, even if he wanted to)?

Burney Brushears' legal incompetence is further evidenced by the fact that, as of this date, Nevada holds his corporation sole to be in "default." One should seriously question whether Gamaliel Ministries and "Bishop" Burney Brushears is competent to be managing anyone else's legal affairs when he can't even manage to keep their own corporation in complaince with Nevada statutes. If Burney Brushears remains in default his corporation sole will be revoked by the Nevada Secretary Of State. Burney Brushears may soon enough discover who the real sovereign of the corporation sole is, when the state of Nevada revokes it.

|

Dean Heller Nevada Secretary of State Corporate Information |

|

| Name: BISHOP OF GAMALIEL MINISTRIES, AND HIS SUCCESSORS, A CORPORATION SOLE |

| Type: Corporation | File Number: C18055-2002 | State: NEVADA | Incorporated On: July 18, 2002 |

| Status: Default | Corp Type: Non-profit | ||

| Resident Agent: | CORPORATE SERVICES OF NEVADA (Accepted) | ||

| Address: | 502 N. DIVISION STREET | ||

| CARSON CITY | NV | 89703- | |

| President: | |||

| Address: | |||

| - | |||

| Secretary: | |||

| Address: | |||

| - | |||

| Treasurer: | |||

| Address: | |||

| - | |||

Update 10-31-05:

Though I have never received a response to my 4-17-04 email to the "Bishop," I was informed today that the "Bishop" has posted a rebuttal on one of his web sites. See Update for further info.

Below is the government registration information for The R.O.C. - GRP, a corporation sole affiliated with Burney Brushears and Gamaliel Ministries. On the About Us page of R.O.C. - GRP's web site are the following disingenuous claims:

These are just two among many of the bogus claims being made by corporation sole peddlers:

Common sense and honesty aren't prerequisites for becoming a corporation sole peddler. Just about anyone can become a corporation sole peddler and just about anyone has, including some very shady characters. Legal competence is also not a prerequisite. Just like Gamaliel Ministries, The R.O.C. - GRP is, as of this date, in default.

According to former R.O.C. - GRP member Bernie Johnson, "R.O.C." actually stands for "Ripping Off Christians."

|

Dean Heller Nevada Secretary of State Corporate Information |

|

| Name: OVERSEER OF THE R.O.C. - GRP, AND HIS SUCCESSORS, A CORPORATION SOLE |

| Type: Corporation | File Number: C17656-2002 | State: NEVADA | Incorporated On: July 16, 2002 |

| Status: Default | Corp Type: Non-profit | ||

| Resident Agent: | CORPORATE SERVICES OF NEVADA (Accepted) | ||

| Address: | 502 N. DIVISION STREET | ||

| CARSON CITY | NV | 89703- | |

| President: | |||

| Address: | |||

| - | |||

| Secretary: | |||

| Address: | |||

| - | |||

| Treasurer: | |||

| Address: | |||

| - | |||

These are just a few examples of the many corporation sole sales companies peddling their wares on the internet. Of the many that I've reviewed I've found no substantive differences between them. They are all legally incompetent and prone to interpret law based upon wishful thinking, rather than objectivity. As such, they are all intellectually dishonest. Most of them are also morally dishonest and worthy to be branded charlatans and con artists.

| Home | Forum | Events | Catalog | Articles | About Us | Site Map | |

|

Copyright 2003, Heal Our Land Ministries, All Rights Reserved

A word about copyright |

|

|

501c3 Tax-Exempt Status: 501c3 Tax Exempt Status and the Church rev. 05-02-05 |