|

The Power To Tax Is The Power To Destroy:

Why The Income Tax System, and the

Tax Protest Movements, Must Be Scrapped

by: Peter Kershaw © 2004

Part 1

Tax protestors aren't the only Americans who hate the IRS and the federal income tax. Many tax-paying Americans also hate the income tax system. The IRS has earned the contempt of millions of taxpayers.

I recently took my wife to see Ray Stevens here in Branson (Ray Stevens pays more in taxes in a single year than I'll probably earn in my entire life). I can't recommend Ray's show (too much bathroom humor); but Ray did have one particularly good song that we appreciated about the income tax entitled, "Ten-Percent." Ray Stevens offers up some valid theology in the chorus of his song when he sings: I recently took my wife to see Ray Stevens here in Branson (Ray Stevens pays more in taxes in a single year than I'll probably earn in my entire life). I can't recommend Ray's show (too much bathroom humor); but Ray did have one particularly good song that we appreciated about the income tax entitled, "Ten-Percent." Ray Stevens offers up some valid theology in the chorus of his song when he sings:

- "If ten-percent is good enough for Jesus, then it ought to be enough for Uncle Sam."

Because of my widely-known anti-501c3 stance, some folks have occasionally made the mistake of believing that my ministry is involved in a form of tax protest. Churches seeking IRS approval, in the form of 501c3 status, has become so commonplace that anyone like myself who speaks out against it runs the risk of being slandered as "anti-government" or a "tax protestor."

While I'm not a tax protestor, and I'm not anti-government (I'm anti-unconstitutional government), I do take pride in the Reformed "Protestant" traditions of my forefathers. There are millions of American Christians that identify themselves as "Protestants" who have never protested anything in their lives. "Protestant" has, by and large, lost its meaning as its members have abandoned their duty to exhort the culture and call the nation to repentance.

While I routinely protest against the 501c3, my protests have never been with the IRS. Protests should be directed toward the source of the problem, and the IRS isn't the problem. The IRS has never required any church to become 501c3, nor has the IRS ever threatened to tax a church if it didn't become 501c3. The IRS for many years has acknowledged 1 that churches are "automatically tax-exempt" and "automatically qualified" to receive tax-deductible contributions, 2 without ever having to apply for 501c3 status from the IRS. As far as I'm concerned, that's a big admission on the IRS' part; so my beef isn't with the IRS.

Not only does an occasional taxpaying Christian misconstrue my anti-501c3 stance as somehow fostering a tax protest movement within the church, many tax protestors have, likewise, assumed the same. Consequently numerous tax protest leaders have solicited me to join their movements (I use the plural "movements," rather than the singular because there is no organized, consolidated tax protest "movement").

Tax protest leaders seem to appreciate much of what I share. They've even occasionally asked me to speak at their conferences. If a tax protest conference runs over into Sunday, they'll usually also ask me to preach a sermon that morning. But if they suppose that my appearance at any of their conferences is a tacit endorsement of their practices, they'd be dead wrong. I speak at such functions because there's always a lot of lost people at "patriot" meetings, and my policy is that I will never pass up an opportunity to share the Gospel of the Lord Jesus Christ with the lost.

One of the few things that I do share in common with contemporary tax protestors is the insight that the income tax system is fundamentally, inherently and irreparably corrupt. The modern income tax system is inherently corrupt because it's based upon a Socialistic system of (in the words of Frederick Bastiat) "legalized plunder." Tax protestors see what most Americans don't -- the fact that no inherently corrupt system can be "overhauled" or "fixed" or "reformed." The only remedy is for the income tax system (by "system" I mean not only the Internal Revenue Code, but also the Internal Revenue Service) to be scrapped, altogether.

"A heavy progressive or graduated income tax" is the second plank of the Communist Manifesto (crafted by Karl Marx in 1848). The stated agenda of an income tax, according to the Socialists who perfected it, is the "redistribution" of the people's wealth: "From each according to his abilities to each according to his needs." The income tax is the tax most-favored by oppressive, despotic governments to subjugate their citizenry. The income tax breeds government corruption and is the very lifeblood of tyrannical government.

The Agency of government tasked with collecting and enforcing any corrupt tax will inevitably become corrupt itself. The income tax system has no place in a free nation, and it's for good reason that President Ronald Reagan stated:

- "Our federal tax system is, in short, utterly impossible, utterly unjust and completely counterproductive. The present system of taxation reeks with injustice and is fundamentally unAmerican. It has earned a rebellion and it's time we rebelled."

The obvious question then is what kind of a "rebellion" was Mr. Reagan speaking of, and what is the appropriate strategy for "rebelling" against this "utterly unjust" and "fundamentally unAmerican" system?

I wholeheartedly concurred with Mr. Reagan when he gave his tax rebellion speech in Williamsburg, Virginia in May, 1983. However, one thing we can safely assume is that Ronald Reagan was not giving a nod to the methods of the tax protest movement, when he spoke of a "tax rebellion." I've found very little to agree with in the tactics of tax protest leaders. Their worldviews are unbiblical and, as such, any solutions they develop will be equally unbiblical.

Tax protestors often presume that I make my living unlicensing churches and, therefore, that is the extent of my legal expertise. However, the fact of the matter is that I earn my living as a paralegal and I only work part-time in the ministry (as an unpaid volunteer). One of my legal specialties is fixing the IRS problems of tax protestors. I know considerably more about the tax protest movement than most tax protestors know about the tax protest movement. I've had considerable exposure to tax protestors, and I count myself uniquely qualified to serve as a cultural commentator on the tax protest subculture.

One of the biggest problems with the modern tax protest movement is the eagerness with which tax protestors embrace urban legends. There's a never-ending stream of urban legends that circulate rapidly and efficiently through the tax protest movement, and even more circulate through it's big brother, the "patriot movement" (aka freedom movement, sovereignty movement, etc.). I refer to these urban legends as "patriot mythology."

The modern patriot movement advances a plethora of "personal liberty" issues above and beyond tax protest. These include SSN revocation, driver's license revocation, debt cancellation, New World Order conspiracies, etc. Like the income tax issue, there's a grain of truth to be found in many patriot issues. However, taking actions based upon a mere grain of truth can produce disastrous results.

This isn't to say that everything that patriots assert is bogus. Indeed, some of the issues that they've brought to light merit further investigation and discussion. However, experience tells me that the contemporary tax protest movement is not the paladin we seek for slaying the income tax dragon, and we'll need to look elsewhere for a champion. The income tax disaster needs to be addressed, so let's listen to what tax protestors have to say, while we remain cautious about following their example.

The vast majority of American taxpayers "voluntarily comply" with the federal income tax motivated largely by IRS intimidation. Americans fear the IRS as much as Russians fear the KGB; perhaps even more so. Former IRS Revenue Officer Richard Yancey describes the IRS as "the most frightening agency on the face of the planet!" No nation that calls itself "free" can truly be free when the people are afraid of their own government.

- "When the people fear the government, tyranny has found victory."

Thomas Jefferson Thomas Jefferson

Fear of the IRS may indeed prompt a high level of "voluntary compliance," but fear never breeds honesty. Most Americans view the IRS as a big bully. Even a child soon figures out how to avoid the bully's repeated shakedown for his lunch money. So it's little wonder that such a large percentage of taxpayers habitually cheat on their taxes. As Will Rogers put it, "The income tax has made more liars of men than the game of golf."

The inequities of the income tax system, and how the IRS chooses to enforce it, cause intense resentment for millions of taxpayers. The middle-class believe they are "paying their fair share," while the wealthy often pay little or nothing. Middle-class perceptions are correct. The rich can readily afford to hire experts to assist them in avoiding most, if not all, of their tax liabilities. It's not uncommon that the wealthy pay no income taxes and, in some cases, file no income tax returns at all. The wealthy generally get away with it and hardly ever get challenged by the IRS. The wealthy have the muscle to stand up to the bully, so the bully moves on to a more vulnerable prey, the middle-class.

The income tax system is outrageously complex and frustrating. No nation can be free when that nation's laws have been deliberately crafted to be so complex that even the licensed professionals find it impossible to agree on what the laws say. There is no legal code in the world as complex, convoluted and confusing as the U.S. Internal Revenue Code:

“The hardest thing in the world to understand is the income tax.” “The hardest thing in the world to understand is the income tax.”

Albert Einstein

(1879-1955)

-

- "Any tax practitioner, any tax administrator, any taxpayer who has worked with the Internal Revenue Code knows that it is probably the biggest mishmash of statutes imaginable. Congress, various Administrations and all the special interest groups have tinkered with it over the years, and now a huge assortment of special interest and pet economic theories have been woven into the great hodgepodge that is today's Internal Revenue Code."

- former IRS Commissioner Roscoe Egger, Jr. (Nov. 30, 1984)

-

- "Eight decades of amendments to the code have produced a virtually impenetrable maze. The rules are unintelligible to most citizens. The rules are equally mysterious to many government employees who are charged with administering and enforcing the law."

- former IRS Commissioner Shirley Peterson (2/92 - 1/93)

-

- "The government has the nerve to tell the people of the country, 'You figure out how much you owe us, and we can't help you because our people don't understand it either; and if you make a mistake, we'll make you pay a penalty for making the mistake'."

There are several congressmen, numerous grass roots organizations, and even the U.S. Treasury, all calling for "tax simplification." Unfortunately, the likelihood of ever achieving any genuine tax simplification is extremely remote. All previous attempts at tax simplification have failed miserably. Ronald Reagan's tax simplification efforts decreased the number of tax brackets to two, but it also resulted in adding thousands of additional pages to the tax code. Moreover, any sincere attempts at tax simplification will necessitate the elimination of deductions that millions of taxpayers have come to rely upon to mitigate their tax liabilities (e.g. Earned Income Tax Credit). That's a political hot potato that few politicians are willing to handle.

Then there are those who propose a "flat tax." In theory a flat tax could be, in itself, a form of tax simplification, which could make the process of filing tax returns more streamlined. Streamlining is certainly desirable, given that the costs of "voluntary compliance" under an obscenely complex tax code are immense: $200 billion and 5.4 billion man-hours per annum. However, a flat tax comes at the expense of millions of taxpayers paying considerably more in taxes because of the elimination of big deductions, such as mortgage interest. Charitable contributions to 501c3 organizations would no longer be tax deductible under a flat tax. Not surprisingly, one of the strongest opponents to a flat tax (as well as the elimination of the income tax) is the National Council of Churches.

Then there are those who believe the solution lies in replacing the income tax with a national sales tax. A national sales tax, as a replacement for the income tax, is as poor an option as the others, since it leaves the IRS in place to enforce the tax (this in spite of what its idealistic proponents claim). Those who laud the NST have failed to learn from the experiences of those countries who have already adopted it. As bad as the income tax is, the NST (known in Europe and elsewhere as VAT, GST, etc.) is even far more destructive to national economy than the income tax. Furthermore, the risk is great that rather than replacing the income tax, our Congress will bait and switch the deal, keeping the income tax (in some modified form) and also giving us a NST on top of it.

Regardless of what Congress does in the way of "reforming" the present tax system, any benefits derived are likely to only last a few years. Congress has an inability to leave laws as they are (the influence of lobbyists is just too great); so we can be confident that the week after the ink dries on a flat tax code, Congress will start messing it up all over again. Speaking of Reagan's tax reforms, Martin Press, vice chairman of the ABA task force on federal tax reform stated, "It didn't take more than two years for Congress to fiddle with it. Lawmakers can't resist loading up the tax code with provisions to benefit special interests." Now the tax system is even more complex and confusing than it has ever been.

Ronald Reagan referred not just to the income tax as "unAmerican." Mr. Reagan was speaking of the entire rapacious D.C. bureaucracy whose voracious appetite and lust for plundering wage-earners is never satiated. The solution isn't to "simplify" it, "flatten" it, or "substitute" it for another unAmerican tax system. The solution is to abolish entirely the "un-American system," thereby ridding ourselves of the corrupt culture which it breeds. 3

There are those who call for various forms of increased IRS accountability, as well as improving congressional oversight. Accountability is certainly a good thing, if it's reasonable to expect that it can be made to work. The reason it can't work is because the IRS considers itself a law unto itself, and it refuses to be held accountable. Within the IRS is a deeply-entrenched rogue culture almost as nefarious and clandestine as the CIA. They get away with it only because everyone is afraid of the IRS, including Congressmen, and even federal judges.

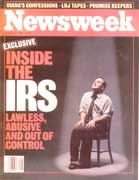

The press, too, is fearful and intimidated by the IRS. As such, don't expect to but rarely see a story about the criminal activities of IRS agents on the evening news or in your newspaper or news magazine. The wire services (e.g. AP) have distributed numerous newsworthy stories of IRS abuse, but the mainstream press hardly ever publish them. One of those rare exceptions was the October 13, 1997 edition of Newsweek, the cover story being entitled, "Inside the IRS: Lawless, Abusive and Out Of Control." The press, too, is fearful and intimidated by the IRS. As such, don't expect to but rarely see a story about the criminal activities of IRS agents on the evening news or in your newspaper or news magazine. The wire services (e.g. AP) have distributed numerous newsworthy stories of IRS abuse, but the mainstream press hardly ever publish them. One of those rare exceptions was the October 13, 1997 edition of Newsweek, the cover story being entitled, "Inside the IRS: Lawless, Abusive and Out Of Control."

The magnitude of IRS abuse warrants that several cover stories each year be devoted to its coverage. Yet, we can count on one hand the number of times the mainstream press has devoted their ink to exposing IRS abuse. The only income tax-related stories the mainstream press faithfully covers are those which serve to scare the people into "paying their fair share." For all intents and purposes, the mainstream press is a lapdog of the IRS.

It would seem that the only people who aren't afraid of the IRS are IRS employees. Since the chief motivation for filing tax returns is usually fear of the IRS, and since many IRS employees don't fear the IRS (and they would certainly be in the ideal position to game the system), hundreds of IRS employees don't file tax returns. How is the IRS to maintain any sense of credibility with the public when many of it's own employees hold themselves above the same laws that they are charged with enforcing?

Several grass roots groups are doing some commendable work in exposing IRS abuse and corruption. However, the solutions they offer up are inadequate and short-sighted, or they've already been tried before and failed miserably. Their intentions are good, but their expectations are unrealistic because they fail to recognize the nature of the problem and its magnitude.

Increased congressional scrutiny and oversight of the IRS was last tried in 1997 with Senator William Roth's IRS hearings. The testimony given by hooded witnesses in their electronically altered voices was truly shocking; but any resulting IRS changes were superficial and not long-lasting. Rather than Congress establishing substantive IRS accountability, it delegated that responsibility to the Treasury Inspector General's Office (TIGTA), which in turn created a program called Employee Integrity. Every year TIGTA offers up a few token criminal prosecutions of IRS employees in order to pacify the public and Congress, and give the impression that they're doing something substantive; but TIGTA's Employee Integrity program is barely scratching the surface of IRS corruption.

Under the leadership of Bush-appointed IRS Commissioner, Mark Everson, the IRS has returned to a pattern of the same abuses that existed prior to Sen. Roth's hearings, perhaps even worse.

- "Can the Ethiopian change his skin, or the leopard his spots? Then may ye also do good, that are accustomed to do evil?" (Jeremiah 13:23)

Identifying problems with the income tax system, and the injustices of its enforcement at the hands of a corrupt tax collection agency whose methods are the envy of the Mafia, have been well documented. The hard work is in developing viable solutions. I have serious doubts that the contemporary tax protest movement is the answer. Nor has the tax protest movement proven itself to be an asset in providing credibility to the argument that the income tax system must be junked. Indeed, lack of credibility is one of the chief problems with the modern tax protest movement.

Many of the claims of tax protestors are gravely lacking in credibility, and are even absurd. Some tax protestors have gone so far as to claim that the IRS is incorporated in Puerto Rico. Others, like Lamarr Hardy, came up with the equally bazaar claim that the IRS was incorporated in Delaware in 1933. I long ago reviewed the "evidence" for these claims and found it to be entirely specious. Such "evidence" would be laughable if it weren't for the fact that so many people have relied upon it, and had their lives ruined, as a direct result.

The number of bogus tax protest theories is limited only by the lack of objective thinking on the part of tax protest leaders. For example, some claim that the IRS is a wholly-owned subsidiary of the Federal Reserve Bank (while others claim that the Secretary of the Treasury is actually a foreign agent of the IMF). This seems to be based upon a confused version of the FRB not being a branch of the federal government. Federal Reserve banks have always asserted that they are not agencies of the U.S government, and have so argued in the courts; 4 but what does that have to do with the IRS?

The thinking of the tax protesters seems to be that if they can show that the IRS is not a branch of the U.S. government, but is actually owned by the incorporated and privately-held FRB, that would strengthen their position that they don't have to pay income taxes. Even if that were true (which it's not) it wouldn't change a thing in terms of the lawfulness, or lack thereof, of the federal income tax.

The IRS refutes the allegation that the IRS is not an agency of the United States government. The IRS asserts that it is a department of the U.S. Treasury (their logo alone should make that self-evident).

The U.S. Treasury, likewise, claims that the IRS is a department of the U.S. Treasury:

- "The Internal Revenue Service (IRS) is the largest of Treasury's bureaus. It is responsible for determining, assessing, and collecting internal revenue in the United States." (U.S. Treasury)

Both the IRS and the FRB deny that the IRS is a branch of the FRB. I don't know of any U.S. official who has ever claimed otherwise, including any U.S. Congressman who disdains the IRS (and there are more of those than most people realize) and who are working to see the personal income tax abolished, such as Rep. Ron Paul.

Do claims by U.S. officials that the IRS is a branch of the U.S. government make it so? Not necessarily. However, attempting to argue otherwise without any hard evidence is not only an exercise in futility, it has cost many people dearly. Raising such issues with the IRS has invariably resulted in an ugly and costly battle that can't be won. Raising such arguments in court usually results in the court imposing a civil penalty in the range of $5,000 to $25,0000 "for raising a frivolous tax protest argument" and "wasting court time with arguments that the courts have already settled."

Was the IRS ever lawfully constituted by the U.S. Congress? Was the 16th Amendment ever legitimately ratified? Many people have serious doubts over these issues, and I share some of those doubts. Unfortunately, the courts don't have such doubts and, whether we like it or not, when it comes to the legalities of the income tax, what counts is the opinions of federal judges. The problem with 16th Amendment ratification, and the plethora of other tax protest arguments, is that people keep taking them into court and winding up in jail. No one has ever won "the 16th Amendment was never legally ratified" argument in any court (and certainly no one has ever won a tax protest argument of any kind with the IRS), so why do tax protestors keep bringing it up?

I'm not unwilling to listen to what the patriots have to say. Indeed, I've found many of their issues to be fascinating. However, I'm not willing to accept every unsubstantiated theory (urban legend) that gets thrown my way, especially when those making their claims refuse to produce any hard evidence to support their theories. Nor would I ever expect anyone else to believe anything I've asserted (e.g. 501c3, church incorporation, etc.) absent my ability and willingness to furnish the black-letter law to support my position.

Regardless of how unjust and corrupt the income tax system is, we must still take cognizance of the 9th Commandment. God draws no distinction, or makes any allowance, if we bear false witness only against our foes, and not against our friends. Either way it's still sin, and God will hold us accountable if we violate His Law against bearing false witness. While the IRS routinely violates the 9th Commandment (and certainly the 8th Commandment), we mustn't allow ourselves to be drawn into the same sinful conduct -- "Two wrongs don't make a right."

Unfortunately, far too many patriots view vengeance as their right, and even a patriotic duty. "Payback" is spoken of regularly at patriot meetings, and payback strategies are routinely taught. Patriots convene their own sham "common law courts" which issue bogus legal judgements. Patriots have filed thousands of baseless commercial liens against IRS agents, and even against federal judges, often for millions of dollars each. They file 1099's against IRS agents. They create bogus "commercial paper" and "certified money orders" to "pay off" mortgages, car loans and credit cards. They do so under the guise of "paying them back with what they paid me." They may view it as righting a wrong, but it's all vengeance, and it does little good to tell them:

- "Dearly beloved, avenge not yourselves, but rather give place unto wrath: for it is written, 'Vengeance is mine; I will repay, saith the Lord'." (Romans 12:19)

While I don't agree with the vengeful spirit rampant in the patriot movement, I do understand why it happens. Virtually all tax protestors are former taxpayers. They usually become tax protestors because the IRS has provided them strong encouragement to do so. Most tax protestors got into the movement because their ox got gored by the IRS. It's IRS abuse that fuels the movement, and the tax protest leaders know it, and they play it up to the hilt. I've had several tax protest leaders tell me, "If the IRS would just stop abusing so many people the tax protest movement would shrivel up and die."

(continued)

Footnotes:

1. Internal Revenue Code 508c1A and IRS Publication 557 (see also this author's book, In Caesar's Grip.)

2. IRS Publication 526 (see also this author's book, In Caesar's Grip.)

3. Witnesses Say IRS Agent Tried to Frame Ex-Senator

IRS agent admits helping dancers for sexual favors (see also Covenant News)

2 Ex-I.R.S. Lawyers' Licenses Suspended for Misconduct (IRS lawyers defraud courts to win 1300 tax shelter cases)

IRS Agent charged with bribery, currency structuring

4. "Examining the organization and function of the Federal Reserve Banks and applying the relevant factors, we conclude that the Federal Reserve Banks are not Federal instrumentalities... but are independent and privately owned and controlled corporations... Federal Reserve Banks are listed neither as 'wholly owned' government corporations [under 31 U.S.C. Section 846] nor as 'mixed ownership' corporations [under 31 U.S.C. Section 856]... It is evident from the legislative history of the Federal Reserve Act that Congress did not intend to give the Federal government direction over the daily operation of the Reserve Banks... The fact that the Federal Reserve Board regulates the Reserve Banks does not make them Federal agencies under the Act." Lewis v. U.S. 680 F.2d 1239, No. 80-5905, 9th Circuit (1982)

The creation of the "Fed" in 1913 under the Federal Reserve Act, and its consequent unconstitutional delegation of money creation powers to a privately-held banking cartel has, ever since that time, fabulously enriched bankers and plunged the nation into a state of perpetual debt. Congressman Ron Paul has introduced legislation to abolish the Fed and restore the powers of money creation to the Congress, where they rightfully belong.

|